Announce that the cup volume has exceeded 100 million! Luckin Coffee once again responded to the rumors of listing in Hong Kong: not enough to weigh

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style)

Luckin Coffee declined to comment on the listing rumors

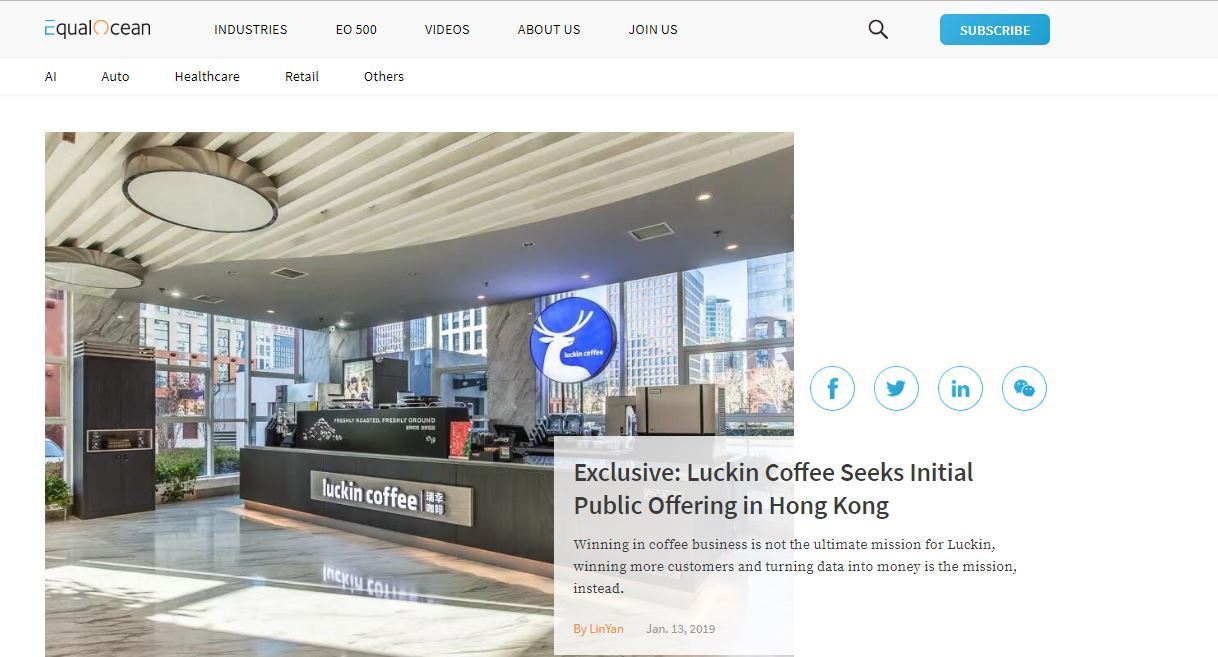

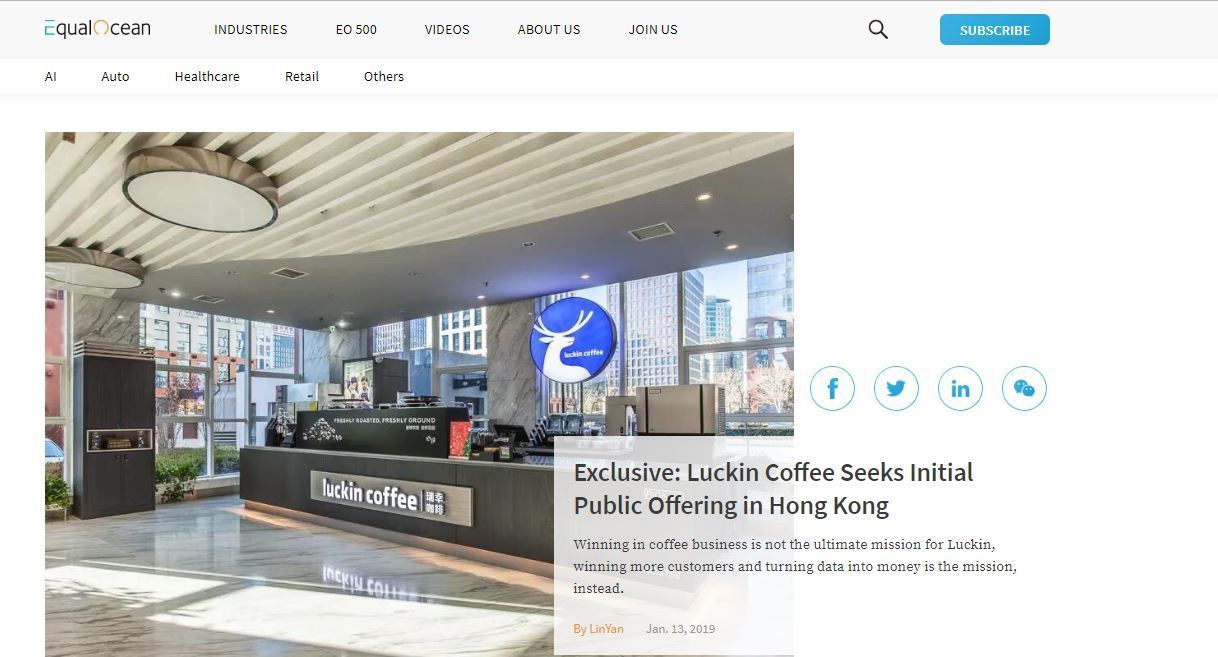

Luckin Coffee, who lost Rmb800m a year and threatened to beat Starbucks, once again reported the news that he was going public. EqualOcean reported on the 14th that investment banks have begun to prepare information for Luckin Coffee on the IPO (initial public offering) on the Hong Kong Stock Exchange, but the media did not release more details about IPO.

Screenshot of EqualOcean official website

In fact, as early as November 2018, Reuters reported that Luckin Coffee had put IPO on the agenda and was in preliminary discussions with overseas investment banks, which could eventually list in 2019, most likely in Hong Kong or New York.

It is worth noting that through the online enterprise certification information inquiry, Luckin Coffee has registered Luckin Coffee (Hong Kong) Co., Ltd.

In addition, Luckin Coffee also announced on the 7th the appointment of Reinout Schakel as the company's chief financial officer and chief strategy officer, reporting to CEO Qian Zhiya. It is reported that Reinout Schakel has served as an executive director of Standard Chartered Bank in Hong Kong and has worked at Credit Suisse and PricewaterhouseCoopers for many years, with more than 10 years of experience in equity, debt financing and mergers and acquisitions.

The two moves of registering overseas enterprises and appointing a new CFO with a deep banking and investment background are also considered by outsiders to be preparing for IPO in Hong Kong.

Luckin Coffee, founded in November 2017 and chaired by Qian Zhiya, a former Shenzhou premium car group COO, began trial operations in January 2018 with the goal of challenging Starbucks in China. Luckin Coffee responded to the resurgence of rumors of listing in Hong Kong, saying "do not comment on this."

It opens 2000 a year and announced yesterday that it has sold 100 million cups.

In the past year, Luckin Coffee is one of the fastest growing startups in China. On December 25, 2018, Luckin Coffee, who has been in business for less than a year, announced that he had completed the layout of 2000 stores for the whole year ahead of schedule, with an average of 5.5 new stores per day. Covering 22 cities in China. In addition, Luckin Coffee announced on the official account yesterday that 100m cups had been sold. By the end of 2018, Luckin Coffee said it had completed the layout of 2073 stores in 22 major cities such as Beijing, Shanghai, Guangzhou and Shenzhen, with 12.54 million consumer customers, and 100 per cent coverage within 500m in the core areas of cities such as Beijing and Shanghai.

By contrast, Starbucks opened 3400 stores 20 years after it entered the Chinese market.

The rapid expansion of offline outlets has benefited from financial support. According to the check, Luckin Coffee received US $200 million in financing in June and December 2018 respectively. Pleasure Capital, Dawei Capital, GIC (GIC), China International Capital Corporation and others are all shareholders, and the company is valued at $2.2 billion after the latest round of financing.

The "money-burning mode" caused great controversy.

However, Luckin Coffee caused discussion in the market mainly by subsidizing users, large-scale advertising and challenging Starbucks. Luckin Coffee revealed that he had lost 857 million yuan in the nine months to the end of December 2018.

Such a "money-burning model" has also aroused public discussion, and even questioned that it will be the next ofo. However, Qian Zhiya said in early January that he would adhere to the subsidy for a long time, lasting for about three to five years. The company and investors had a highly consistent attitude on the subsidy strategy, and they were also worried that Lucky had just completed round B financing and had enough cash in hand.

Lucky CMO Yang Fei also said that there is no problem with the company's cash flow and can remain unprofitable for three to five years, so he does not worry about the tight capital chain and will not become the next ofo.

In 2019, Luckin Coffee also set three strategic goals to accelerate the development of the market: more than 2500 new stores and more than 4500 total stores; at the same time, it will surpass Starbucks in terms of stores and cups to become the largest chain coffee brand in China; in addition, Luckin Coffee claims to provide customers with high-quality, cost-effective and convenient products.

Hong Kong media analysis: not enough to weigh!

However, according to the analysis of Hong Kong media, the loss does not constitute an obstacle for Luckin Coffee to be listed on the main board of the Hong Kong Stock Exchange. According to the main board listing rules of HKEx (00388), listing in Hong Kong is required to pass at least one of the "profit test", "market capitalization / earnings / cash flow test" and "market capitalization / earnings test". However, any of the above requires the issuer to have business records for not less than three fiscal years.

Luckin Coffee, which was established in 2017 and opened its first store early last year, does not meet the requirements for listing on the main board of Hong Kong stocks. Even if it is intended to be listed, it has to wait for "enough scale".

Source: Hong Kong Ming Pao, United Daily News

END

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Has Luckin Coffee been listed? Luckin Coffee is coming to Hong Kong IPO soon. The investment bank has prepared listing materials for him.

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) lost 800 million yuan a year, Luckin Coffee, who once threatened to beat Starbucks, is rumored to be going public. EqualOcean reported on the 14th that investment banks have begun to prepare funds for Luckin Coffee on the IPO (initial public offering) on the Hong Kong Stock Exchange.

- Next

Luckin Coffee CEO Qian Zhiya won the Top Ten Economic person of the year Award of 2018

Professional coffee knowledge exchange more coffee bean information please follow the coffee workshop (Wechat official account cafe_style) on the evening of January 18. The 2018 Top Ten Economic person of the year Awards ceremony jointly produced by Sina Finance, People's Daily (client) and Wu Xiaobo Channel was held at the Beijing Performing Arts Center on January 18, 2019. Luckin Coffee founder and CEO Qian Zhiya won the top 10 in 2019.

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?