Analysis on the Market pattern and Development trend of China's Coffee Industry in 2015

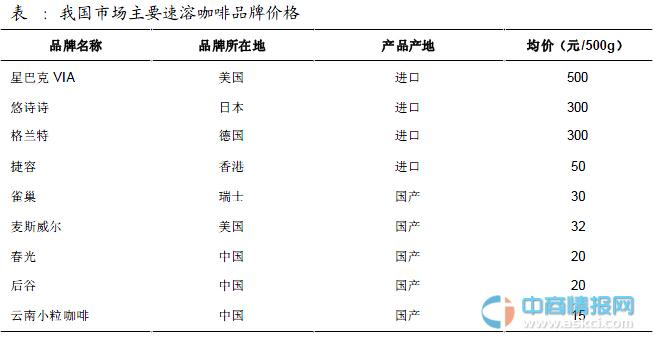

Judging from the current competition pattern of China's coffee industry, in the field of instant coffee, domestic products of foreign brands are in a monopoly position in the middle and low-end market segments, and coffee giants such as Nestle and Maxwell have a market share of more than 80%. However, the local coffee enterprises in China, represented by Gu Coffee and Chunguang Food, are in a period of transition from planting and rough processing of raw beans to finished coffee products of their own brands. at present, the deep processing ability of the products is still relatively low, and the brand awareness needs to be improved. it is difficult to compete directly with foreign brands in product price and sales scale. The high-end market segment is mainly occupied by imported products of foreign brands.

In the field of freshly ground coffee, imports from foreign brands still dominate this high-end market segment. The local coffee enterprises in China, represented by coffee towns, import boutique coffee beans from all over the world, and then bake, package and sell them at home. Its products have a certain price advantage in the middle and low-end market segments, and gradually expand their share.

In the field of coffee chain, the local coffee enterprises represented by the above island coffee occupy a considerable market share by virtue of their first-in advantages and channel advantages. Foreign brands represented by Starbucks, relying on its brand image and differentiated competitive strategy, occupy a leading position in the subdivision of "first-tier cities" and "espresso". In recent years, some emerging coffee chain brands have gradually broken the monopoly position of Starbucks and Shangdao coffee market by virtue of their accurate market positioning and unique business model, driving the chain coffee market to develop in a more diversified direction.

According to market data, the coffee industry is growing at an annual rate of 25%, and coffee is becoming a bright spot of urban civilization and economic growth. The consumption of second-and third-tier cities is increasing, and the market share is also increasing, which will become the core driving market of China in the next 20 years.

After nearly a decade of rapid development, China's coffee industry has shown two major trends: the development potential of ground coffee is greater than that of instant coffee. As consumers' coffee consumption taste is getting higher and higher. Instant coffee is far from representing coffee consumption, consumers begin to recognize the brand, style and purity of coffee, and want to enjoy the fun of coffee. The popularity of office and home coffee machines provides convenient conditions for consumers to consume coffee beans.

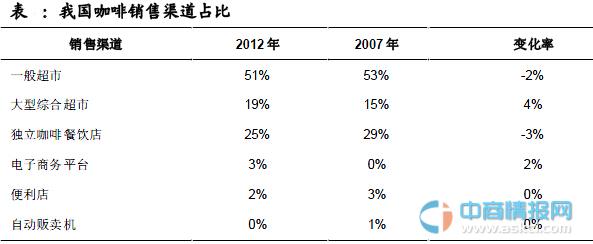

The channels of coffee consumption in China are developing towards diversification. The main consumption channels of China's coffee market are large supermarkets and cafes, accounting for 51.3% and 25.1% of the market share respectively. Compared with 2007, the proportion of most sales channels has decreased, only large-scale integrated supermarkets and e-commerce channels have increased.

Source: China Business Intelligence Network

Important Notice :

前街咖啡 FrontStreet Coffee has moved to new addredd:

FrontStreet Coffee Address: 315,Donghua East Road,GuangZhou

Tel:020 38364473

- Prev

Blue bottle Japan's second branch Aoyama Blue Bottle Cafe

Schemata Architects designed Blue Bottle Coffee's second store in Japan, located in Tokyo's Qingshan District, just a few minutes' walk from Meisando Station. The cafe is located in a quiet block surrounded by trees, occupying the second floor of a building, and a few blocks away is the noisy main street. On the second floor, the spacious balcony is decorated.

- Next

Starbucks only has coffee? It's actually a technology company!

Do you know that Starbucks is a coffee that brings together literary and artistic young people? Certainly. Starbucks is a cafe and the world's most awesome chain of cafes. Many people have now developed another name for it: Starbucks Art Photo Studio. Whose moments don't have many pictures of holding coffee cups at Starbucks! However, this is not high-end enough, his most powerful identity is his

Related

- What brand of black coffee is the most authentic and delicious? what are the characteristics of the flavor of the authentic Rose Summer Black Coffee?

- Introduction to the principle and characteristics of the correct use of mocha pot A detailed course of mocha pot brewing coffee is described in five steps.

- Which is better, decaf or regular coffee? how is decaf made?

- How much is a bag of four cat coffee?

- How about four Cat Coffee or Nestle Coffee? why is it a cheap scam?

- Which is better, Yunnan four Cats Coffee or Nestle Coffee? How about cat coffee? is it a fake scam? why is it so cheap?

- How about Cat Coffee? what grade is a hoax? which instant coffee tastes better, four Cat Coffee, Nestle Coffee or G7 coffee?

- Process flow chart of coffee making-Starbucks coffee making process what coffee tastes good at Starbucks

- The top ten best coffee beans in the world Rose summer coffee or Tanzanian coffee tastes good

- Yunnan four cat coffee is good to drink?_four cat coffee is a big brand? four cat blue mountain coffee is fake?